mass tax connect certificate of good standing

Companies that intend to expand abroad might also need to obtain certificate of good standing and then certify it for foreign use either. In order to obtain a Corporate Tax Lien Waiver businesses must file corporate returns.

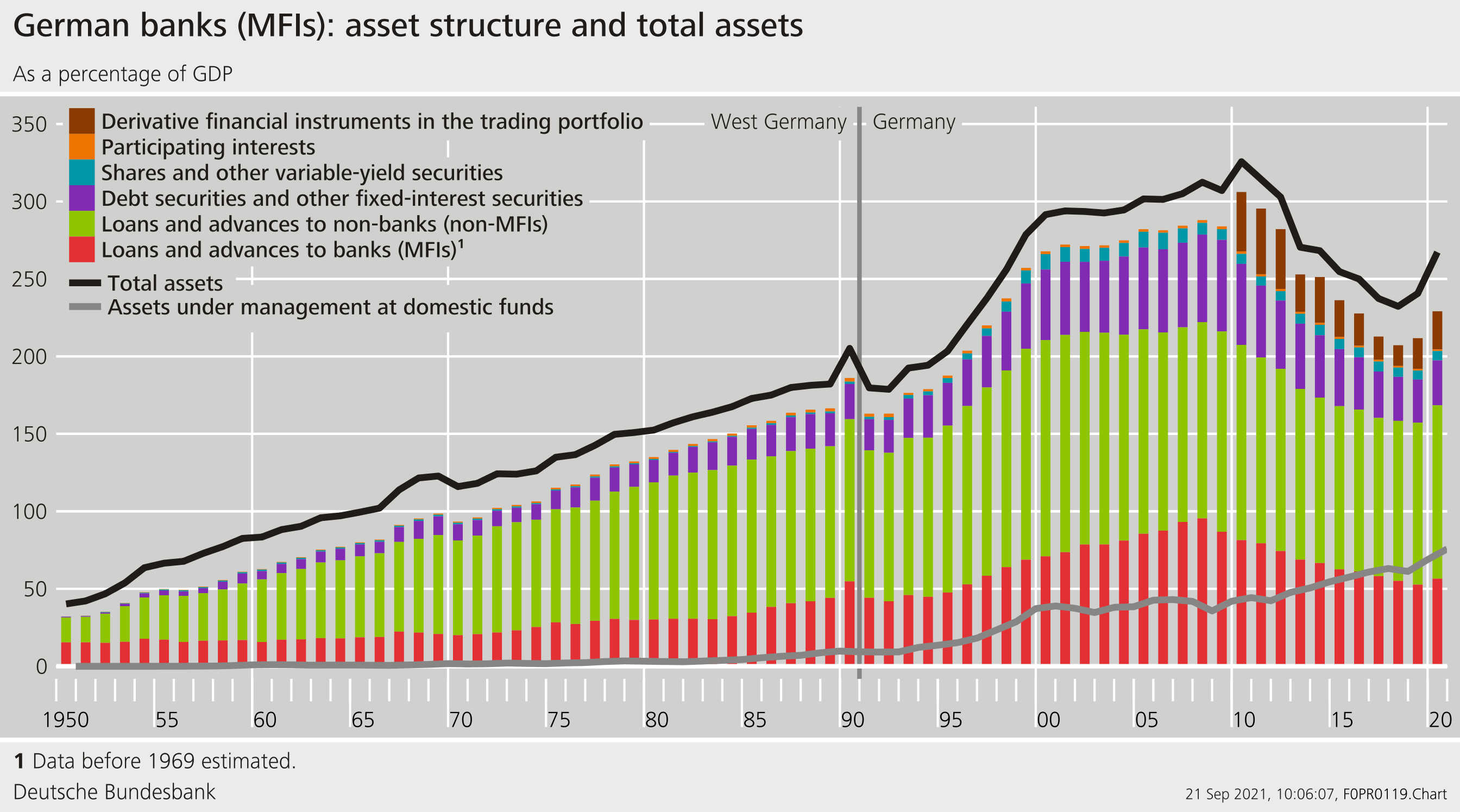

The Coronavirus Pandemic As An Exogenous Shock To The Financial Industry Deutsche Bundesbank

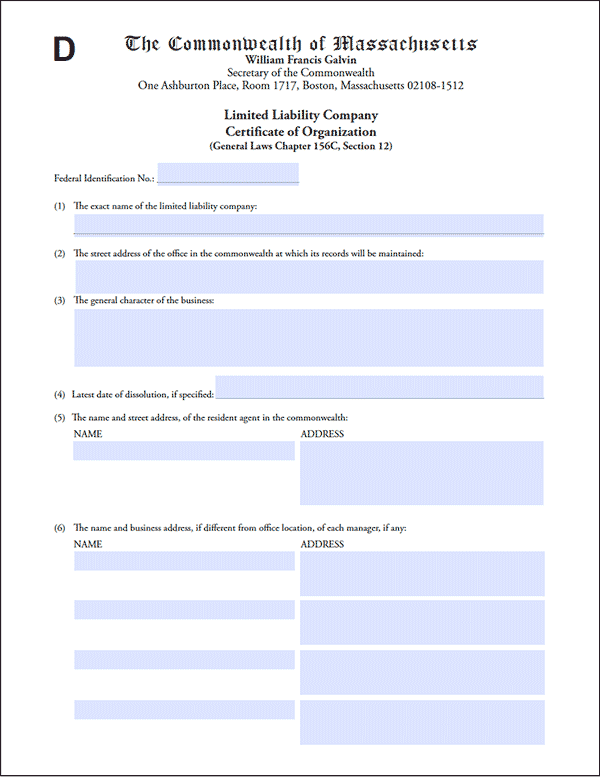

The Foreign or Domestic company must be registered as a legal entity with the Massachusetts MA Secretary of the Commonwealth MA Corporation MA LLP or MA LLC.

. When completing this form be sure to print legibly. To delete a payment i f the payment was made while logged into an MassTaxConnect account. Payments in MassTaxConnect can be deleted from the Submissions screen.

Manage account access for tax preparers electronically. Massachusetts Department of Revenue Request for a Certificate of Good Standing andor Tax Compliance or Waiver of Corporate Tax Lien PO Box 7073 Boston MA 02204. A Certificate of Good Standing-Tax Compliance or a Corporate Tax Lien Waiver is the answer when individuals corporations and other organizations need proof theyve filed their tax returns and paid tax bills in order to.

Please enable JavaScript to view the page content. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Most states want to see a certificate of good standing or its equivalent before allowing a company to do business in that state as a foreign entity process called foreign qualification.

Revenue PO Box 7066 Boston MA 02204 or fax to 617 887-6262. Payments that have a status of In Process or Completed cannot be deleted. Normal processing takes up to 5 days plus additional time for.

Complete in Just 3 Steps. Massachusetts Certificate Tax Form. For example the certification of your companys status as of January 1 2021 must be filed by April 1 2021.

This can be done online by mail or by fax. Once your business remains compliant with the state you can request a Massachusetts certificate of good standing from the Department of Revenue. Please enable JavaScript to view the page content.

How to Upload an Excel Spreadsheet. Under Individual choose Request a certificate of good standing. To request a Certificate of Good Standing andor Tax Compliance for businesses go to wwwmassgovMTC.

Obtaining Good Standing Certificate. Ad Apply For Your Certificate of Good Standing. Under Individual choose Request a certificate of good standing.

If this is a request for a Corporate Tax Lien Waiver then it must be requested via paper. Please note that account information for tax year 2010 and after will be carried over to MassTaxConnect. Httpsmtcdorstatemausmtc_ or search for mass tax connect 2.

MassTaxConnects Paid Family and Medical Leave PFML videos are. To request a Certificate of Good Standing andor Tax Compliance for businesses go to wwwmassgovMTC. Prove That Your Company Has Met All State Requirements And Is Authorized To Do Business.

Requesting Tax StatusTax Good Standings from MA Dept of Revenue 1. The MassTaxConnect information page is regularly updated and includes Frequently Asked Questions which cover a range of topics. Via fax using the attached request form.

This video tutorial shows you how to request a Certificate of Good Standing from the MassTaxConnect homepageSubscribe to DOR on Social MediaYouTubehttpsw. Renew a liquor or professional license. Penalty and interest calculator.

Your support ID is. In order to be in Good Standing a Massachusetts Corporation or LLC must be in compliance with the following. Order Your Massachusetts Certificate of Good Standing.

The Annual Certifications of Entity Tax Status as of January 1 of each year must be filed on or before the following April 1. DOR strongly recommends filing your request online. The payments must have a status of Submitted to be deleted.

Online processing costs 15 and the certificate will be emailed to you the same day. The filing fee is 125 for corporations and 500 for LLCs. View Sample of Certificate of Good Standing Please submit the certificate to ETPLMassMailStateMAUS.

Corporations often need Certificates of Good Standing in order to obtain financing renew licenses or enter into other business transactions. How to Get a Massachusetts Certificate of Good Standing. Processing of a paper application can take 4 to 6 weeks.

Your support ID is. How to Register for Paid Family and Medical Leave Contributions. You can order a certificate of good standing in the Commonwealth of Massachusetts by mail in person or online but we recommend online.

Navigate to the S earch S. Name of organization Trade name or DBA Federal ID or Social Security number required Street address CityTown State Check if new address Contact person Zip Daytime. How to Opt in and Contribute to Paid Family and Medical Leave as a Self-Employed Individual.

How do I delete a payment. How to File a Return and Remit a Contribution for Paid Family and Medical Leave. A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance.

If you must apply by paper select Request for a Certificate of Good Standing andor Tax Compliance or Waiver of Corporate Tax Lien. If approved the Certificate of Good Standing will be mailed within 24-48 hours. For further information call 617 887-6367.

Shortly after April 1 2021 the 2021 Corporations Book will be released online to assist local boards of.

Llc Massachusetts How To Start An Llc In Massachusetts Truic

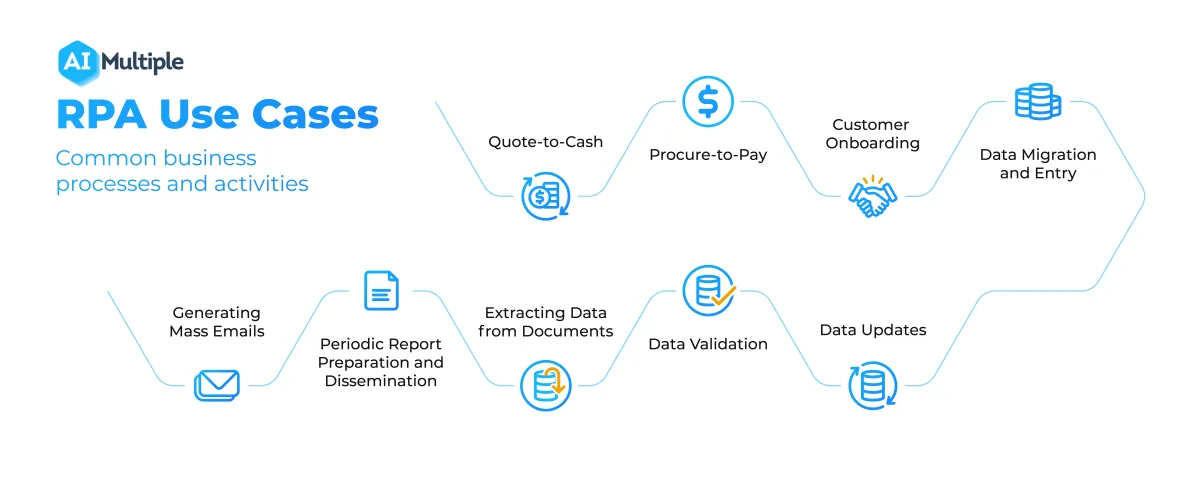

Top 65 Rpa Use Cases Projects Applications Examples In 2022

Digitalisierte Sammlungen Der Staatsbibliothek Zu Berlin Werkansicht A Manual Of The District Of Vizagapatam In The Presidency Of Madras Ppn622448595 Phys 0042 Fulltext Endless

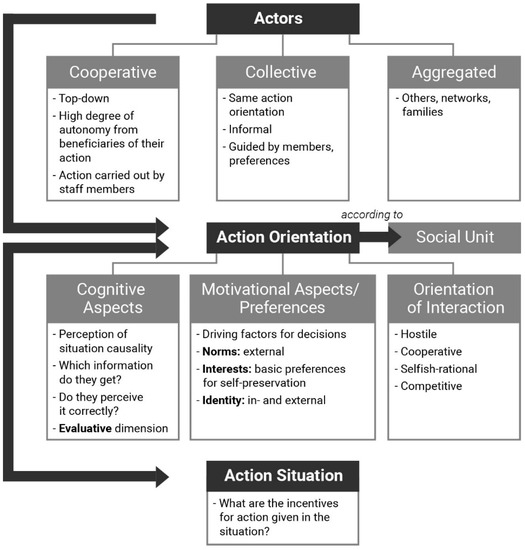

Sustainability Free Full Text Creating Transdisciplinary Teaching Spaces Cooperation Of Universities And Non University Partners To Design Higher Education For Regional Sustainable Transition Html

Certificate Of Good Standing Massachusetts Truic

How To Log In To Masstaxconnect For The First Time Youtube

How To Log In To Masstaxconnect For The First Time Youtube

What Is A Certificate Of Good Standing How Do I Get One Ask Gusto

Massachusetts Sales Tax Small Business Guide Truic

Introducing Cobrabraids Tech Bracelet With Up To 10 Feet Of 550 Paracord And Embedded In The Bracelet Is A 4gb Usb Drive Save Yo Pulseiras Pendrive Bracelete

How To Get A Certificate Of Good Standing In Your State Forbes Advisor

Massachusetts Short Term Rental Tax Guide Weneedavacation Com